Compilation of Policies in January 2025

1.General Administration of Customs Announcement No. 2 of 2025 (Announcement on the Abolition and Declaration of Obsolescence of Certain Normative Documents (II))

http://www.customs.gov.cn/customs/302249/302266/302267/6318346/index.html

Issuance Date: January 6, 2025

Effective Date: January 6, 2025

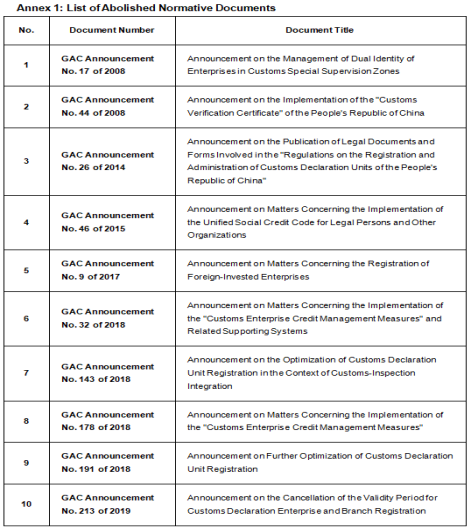

In accordance with actual work requirements, the General Administration of Customs has decided to abolish and declare obsolete certain normative documents. The specific list of documents is provided in Annexes 1 and 2. This announcement shall take effect from the date of its issuance.

2.General Administration of Customs Announcement No. 3 of 2025 (Announcement on the Commodity Code Declaration Requirements for Cypermethrin)

http://www.customs.gov.cn/customs/302249/302266/302267/6318379/index.html

Issuance Date: January 7, 2025

Effective Date: January 8, 2025

Recently, the Ministry of Commerce issued Announcement No. 2 of 2025, deciding to implement provisional anti-dumping measures on cypermethrin originating from India starting from January 8, 2025. The specific scope of products subject to provisional anti-dumping measures and the corresponding deposit rates have also been clarified.When declaring the import of cypermethrin (HS code 29269090), the commodity code should be declared as 2926909013 for cypermethrin with effective component CAS numbers 52315-07-8, 67375-30-8, and 1315501-18-8.Policy Interpretation:In accordance with the provisions of the "Anti-Dumping Regulations of the People's Republic of China," the Ministry of Commerce has decided to implement provisional anti-dumping measures on cypermethrin originating from India starting from January 8, 2025. The specific measure is the collection of deposits. Importers of the investigated products shall provide the corresponding deposits to the customs authorities based on the deposit rates determined in the preliminary ruling for each company.Calculation Method for Deposit Collection:

oScope of Collection: Cypermethrin originating from India (HS code 29269090).

oCalculation Formula: Deposit Amount = (Customs-ascertained duty-paid price × Deposit Collection Rate) × (1 + Import VAT Rate).

oDeposit Rates for Each Company: Specific rates are listed in the "Preliminary Ruling on the Anti-dumping Investigation of Cypermethrin Originating from India" attached to the announcement.

3.General Administration of Customs Announcement No. 7 of 2025 (Announcement on the Release of the Assessment Results of Port Public Health Core Capabilities in Accordance with the International Health Regulations (2005) for 2024)

http://www.customs.gov.cn/customs/302249/302266/302267/6345134/index.html

Issuance Date: January 13, 2025

Effective Date: January 13, 2025

In order to implement the requirements of the "Healthy China 2030" plan, fulfill the obligations of the contracting party to the International Health Regulations (2005), and continuously consolidate and enhance the level of port public health core capabilities in China, the General Administration of Customs organized the assessment of port public health core capabilities for 11 ports in 2024 and announced the list of 268 qualified ports nationwide.

4.Ministry of Commerce Announcement on Measures Against 10 U.S. Companies Including Lockheed Martin Missiles and Fire Control on the Unreliable Entity List

https://www.mofcom.gov.cn/zcfb/blgg/art/2025/art_6d2528ea238d47fcb93840689773ba87.html

Issuance Date: January 2, 2025

Effective Date: January 2, 2025

In order to safeguard national sovereignty, security, and development interests, in accordance with the "Foreign Trade Law of the People's Republic of China," "National Security Law of the People's Republic of China," "Law of the People's Republic of China on Counteracting Foreign Sanctions," and other relevant laws, the Unreliable Entity List mechanism, based on Articles 2, 8, and 10 of the "Regulations on the Unreliable Entity List," has decided to include the following companies that participated in arms sales to the Taiwan region into the Unreliable Entity List and take the following measures:

Prohibition of the above companies from engaging in import and export activities related to China;

Prohibition of new investments in China by the above companies;

Prohibition of entry into China by senior management personnel of the above companies;

Non-approval and revocation of work permits, stay, or residence qualifications in China for senior management personnel of the above companies.

Matters not covered in this announcement shall be implemented in accordance with the "Regulations on the Unreliable Entity List."

5.Ministry of Commerce Announcement No. 1 of 2025: Announcement on the Inclusion of 28 U.S. Entities in the Export Control List

https://www.mofcom.gov.cn/zcfb/blgg/art/2025/art_0ce37a4491f2470484f6903a6863de99.html

Issuance Date: January 2, 2025

Effective Date: January 2, 2025

In accordance with the "Export Control Law of the People's Republic of China" and the "Regulations on Export Control of Dual-Use Items" and other relevant laws and regulations, in order to safeguard national security and interests and fulfill international obligations such as non-proliferation, it is decided to include 28 U.S. entities, including General Dynamics Corporation, in the export control list (see Annex) and take the following measures:

oProhibition of exports of dual-use items to the 28 U.S. entities; any ongoing export activities shall be immediately halted.

oIn special cases where exports are indeed necessary, exporters shall apply to the Ministry of Commerce.

Export Control List (January 2, 2025)

1.General Dynamics Corporation

2.L3 Harris Technologies

3.Intelligent Epitaxy Technology

4.Clear Align LLC

5.Boeing Defense, Space & Security

6.Lockheed Martin Corporation

7.Raytheon Missiles & Defense

8.Lockheed Martin Missiles and Fire Control

9.Lockheed Martin Aeronautics

10.Raytheon/Lockheed Martin Javelin Joint Venture

11.Raytheon Missile Systems

12.General Dynamics Ordnance and Tactical Systems

13.General Dynamics Information Technology

14.General Dynamics Mission Systems

15.Inter-Coastal Electronics

16.System Studies & Simulation

17.IronMountain Solutions

18.Applied Technologies Group

19.Axient

20.Lockheed Martin Missile System Integration Lab

21.Lockheed Martin Advanced Technology Laboratories

22.Lockheed Martin Ventures

23.Anduril Industries

24.Maritime Tactical Systems

25.Pacific Rim Defense

26.AEVEX Aerospace

27.LKD Aerospace

28.Summit Technologies Inc.

6.Ministry of Commerce Announcement No. 3 of 2025: Announcement on the Final Conclusion of the Trade and Investment Barrier Investigation into the EU's Practices under the Foreign Subsidies Regulation

https://www.mofcom.gov.cn/zcfb/blgg/art/2025/art_9002a4cc883748038f0e555eebfedc8c.html

Issuance Date: January 9, 2025

Effective Date: January 9, 2025

At the request of the China Chamber of Commerce for Import and Export of Machinery and Electronic Products, and in accordance with the "Foreign Trade Law of the People's Republic of China" and the "Rules on Foreign Trade Barrier Investigations," the Ministry of Commerce issued Announcement No. 28 of 2024 on July 10, 2024, deciding to conduct a trade and investment barrier investigation into the practices of the EU under the Foreign Subsidies Regulation (FSR) and its implementing regulations.The investigation has now concluded. Based on the results and Article 31 of the "Rules on Foreign Trade Barrier Investigations," the Ministry of Commerce has determined that the EU's practices under the FSR and its implementing regulations constitute trade and investment barriers as stipulated in Article 3 of the "Rules on Foreign Trade Barrier Investigations."Policy Interpretation:

Investigation Background:On June 17, 2024, the China Chamber of Commerce for Import and Export of Machinery and Electronic Products submitted an application to the Ministry of Commerce, requesting an investigation into the EU's practices under the FSR and its implementing regulations. The Ministry of Commerce issued an announcement on July 10, 2024, initiating the investigation.

Investigation Conclusion:The Ministry of Commerce has determined that the EU's practices under the FSR constitute trade and investment barriers as stipulated in Article 3 of the "Rules on Foreign Trade Barrier Investigations."

Specific Issues:

1.Market Access Restrictions: The investigation showed that 93% of stakeholders believe that the EU's FSR investigations restrict Chinese enterprises, products, and investments from entering the EU market. Chinese enterprises have been forced to abandon bidding projects worth approximately 7.6 billion RMB, while other affected projects exceed 8 billion RMB.

2.Damage to Market Competitiveness: 98% of stakeholders believe that the EU's FSR practices have harmed the competitiveness of Chinese enterprises in the EU market. Enterprises have had to increase significant human, material, and financial resources to respond to the investigations, resulting in a substantial increase in operating costs.

3.Contract and Investment Risks: EU tenderers have added contract termination clauses after enterprises have won bids, leading Chinese enterprises to abandon contracts to avoid losses. Additionally, FSR investigations have increased the compliance burden for Chinese enterprises investing in the EU, with over 50% of enterprises indicating that they will adjust their investment strategies towards the EU.

Policy Significance:

1.Protection of Enterprise Rights: The investigation conclusions provide strong support for Chinese enterprises affected by the EU's FSR investigations and help to push the EU to correct its unreasonable practices.

2.Promotion of Fair Trade: This conclusion demonstrates China's firm opposition to any form of trade protectionism and its commitment to maintaining the fairness and transparency of the multilateral trading system.

3.Facilitation of Bilateral Dialogue: The Ministry of Commerce has indicated that it will continue to promote objective, fair, and transparent implementation of the FSR by the EU through dialogue and cooperation.

7.Ministry of Commerce Order No. 2 of 2025: Decision to Abolish the "Measures for the Administration of Export Registration of Sensitive Items and Technologies"

https://www.mofcom.gov.cn/zcfb/blgg/art/2025/art_123e300d41b34ba8bdf4951027e2ea2e.html

Issuance Date: January 27, 2025

Effective Date: January 27, 2025

The "Decision to Abolish the Measures for the Administration of Export Registration of Sensitive Items and Technologies" was deliberated and adopted at the 18th Ministry Meeting of the Ministry of Commerce on January 23, 2025, and is hereby announced, taking effect from the date of publication.According to the "Regulations on Export Control of Dual-Use Items," the "Measures for the Administration of Export Registration of Sensitive Items and Technologies" (Order No. 35 of the Ministry of Foreign Trade and Economic Cooperation, 2002) are hereby abolished.

8.Notice on the Implementation of Special Action Plan for SMEs to Go Global by the Ministry of Industry and Information Technology

https://wap.miit.gov.cn/zwgk/zcwj/wjfb/tz/art/2025/art_659eb43636724d93820818ee1aeaa2e5.html

Issuance Date: January 15, 2025

Effective Date: January 15, 2025

In order to implement the decisions and deployments of the Party Central Committee and the State Council on supporting the development of SMEs, to facilitate domestic and international dual circulation, and to help SMEs expand into overseas markets and integrate into the global industrial and supply chains, forming new competitive advantages in international competition, the Ministry of Industry and Information Technology has organized the Special Action Plan for SMEs to Go Global.Action Goals:Through this special action plan, the systematic supply of services for going global will be strengthened. Service institutions will be precisely matched with SMEs that have intentions to go global, providing professional services to help SMEs expand into international markets, improve information channels, enhance risk prevention capabilities, and promote the international development of SMEs.Key Work:

(1) Policy Services for Enterprises:Enhance the collection, organization, research, and dissemination of policy information both domestically and internationally. Provide information on the political environment, laws and regulations, policy access, industrial development, and market analysis of target countries (regions). Organize specialized training and exchange activities to promote and interpret policies supporting SMEs going global. Establish an online learning course library to provide SMEs with practical learning resources. Increase the publicity of practical cases of going global to enhance SMEs' understanding of the prospects of going global. Encourage the exploration and application of large artificial intelligence models to improve the timeliness and accuracy of policy delivery.

(2) Market Expansion Services:Organize information on advantageous industries and establish communication channels and cooperation mechanisms with industrial departments, platform institutions, and upstream and downstream enterprises in target countries (regions), encouraging SMEs to "go global together." Increase support for SMEs to participate in international exhibitions, organize various cross-border matching activities, and accurately connect with overseas customer resources. Strengthen research and alignment with foreign technical standards and regulations, match the technical cooperation needs of SMEs overseas, and provide international standard testing and certification services. Encourage cloud service providers to offer high-quality cloud services for SMEs going global. Leverage the brand, market, channel, technology, and computing power advantages of Internet platforms and new media to help SMEs expand into overseas markets and enhance brand influence. Utilize the international service institution resources of Hong Kong and Macao to help SMEs "go global by leveraging their strengths."

(3) International Talent Services:Support the use of international talent platform resources to help SMEs expand channels for introducing international talents. Support enterprises in jointly building international talent training and exchange platforms with professional colleges, conducting activities such as training, capability evaluation, and skill exchange to enhance the cultivation of international talents. Encourage service institutions to establish local talent training mechanisms with SMEs, providing local talent services for SMEs going global through overseas employment service platforms and project employment cooperation.

(4) Management Improvement Services:Focus on areas such as international development strategy planning, cross-border operations, carbon footprint, brand promotion, local human resource management, and environmental, social, and corporate governance for SMEs, providing customized management consulting services and solutions. Conduct cross-border compliance guidance services for market access, security reviews, industry regulation, foreign exchange management, tax laws, labor rights protection, environmental protection standards, and data security protection in target countries (regions) to help SMEs meet local and supply chain social responsibility requirements and enhance their overseas image. Encourage digital service providers to develop or adapt "small, fast, light, and accurate" digital products and solutions related to SMEs going global.

(5) Cross-Border Financial Services:Encourage banks to innovate in cross-border financing products and develop financing products that match the characteristics of SMEs, such as light assets, good growth potential, and high flexibility, to improve the convenience of cross-border financing for SMEs. Encourage overseas branches of banks to strengthen support for the overseas business of SMEs. Support service institutions in expanding overseas financing channels for SMEs, providing financial risk assessment and contingency plan services to guard against financial risks such as changes in foreign exchange control policies, insufficient foreign exchange reserves, and exchange rate fluctuations in target countries (regions), guiding SMEs to choose safe and high-quality financial partners and preventing financial information leakage risks.

(6) Rights Protection Services:Leverage the roles of law firms, tax service institutions, and international commercial arbitration institutions to provide SMEs with overseas rights protection services such as contract review, compliance consulting, dispute resolution strategies, tax impact analysis and planning, and representation in cross-border litigation and arbitration. Encourage intellectual property service institutions to provide SMEs with services such as intellectual property risk assessment, international trademark registration agency, and guidance on responding to overseas intellectual property infringement. Encourage service institutions to establish and improve foreign emergency service channels, enhance the efficiency of SMEs in responding to overseas disputes, establish a coordinated information communication mechanism, and continuously improve the overseas rights protection assistance system.

9.Notice on Adjusting the "Zero-Tariff" Policy for Raw and Auxiliary Materials in the Hainan Free Trade Port

https://gss.mof.gov.cn/gzdt/zhengcefabu/202501/t20250126_3955150.htm

Issuance Date: January 24, 2025

Effective Date: January 24, 2025

In order to further expand the policy effect and support the construction of the Hainan Free Trade Port, the following adjustments to the "Zero-Tariff" policy for raw and auxiliary materials in the Hainan Free Trade Port are hereby notified:

1.Add 297 items, including unroasted coffee, ethylene, and machine parts, to the "Zero-Tariff" list of raw and auxiliary materials in the Hainan Free Trade Port. The specific scope is provided in the annex.

2.Add the following content to the maintenance scenarios listed in Article 3 of the "Notice on the 'Zero-Tariff' Policy for Raw and Auxiliary Materials in the Hainan Free Trade Port" (Finance and Tax [2020] No. 42):

Maintenance of "Zero-Tariff" yachts, self-use production equipment (including related parts) imported under the "Notice on the 'Zero-Tariff' Policy for Means of Transport and Yachts in the Hainan Free Trade Port" (Finance and Tax [2020] No. 54), "Notice on the 'Zero-Tariff' Policy for Self-Use Production Equipment in the Hainan Free Trade Port" (Finance and Tax [2021] No. 7), and "Notice on Adjusting the 'Zero-Tariff' Policy for Self-Use Production Equipment in the Hainan Free Trade Port" (Finance and Tax [2022] No. 4) shall be exempt from import duties, import VAT, and consumption tax.

Without the consent of the customs authorities and the payment of import duties, import VAT, and consumption tax, "Zero-Tariff" parts shall not be used for other purposes.

3.Modify Article 4 of the "Notice on the 'Zero-Tariff' Policy for Raw and Auxiliary Materials in the Hainan Free Trade Port" (Finance and Tax [2020] No. 42) as follows:

"Zero-Tariff" raw and auxiliary materials are limited to production use by enterprises within the Hainan Free Trade Port and are subject to customs supervision. They shall not be transferred. In case of enterprise bankruptcy or other legal reasons that necessitate the transfer of "Zero-Tariff" raw and auxiliary materials, customs consent must be obtained, and tax payment procedures must be completed before transfer. Where "Zero-Tariff" raw and auxiliary materials are transferred to entities eligible for policy benefits, import duties, import VAT, and consumption tax shall be exempted. When goods manufactured from "Zero-Tariff" raw and auxiliary materials are transferred, the import duties, import VAT, and consumption tax on the raw and auxiliary materials must be paid. The above transfer actions shall be subject to the collection of domestic VAT and consumption tax in accordance with regulations.

The export of "Zero-Tariff" raw and auxiliary materials and goods manufactured from them shall be subject to the current tax policies for exported goods.

4.Other contents of the "Zero-Tariff" policy for raw and auxiliary materials shall continue to be implemented in accordance with the relevant provisions of the "Notice on the 'Zero-Tariff' Policy for Raw and Auxiliary Materials in the Hainan Free Trade Port" (Finance and Tax [2020] No. 42).

5.This notice shall take effect from February 1, 2025.